UNDP'S Insurance and Risk Finance - 2023 Snapshot

THE IRFF IN NUMBERS: INCREASING INFLUENCE AND IMPACT

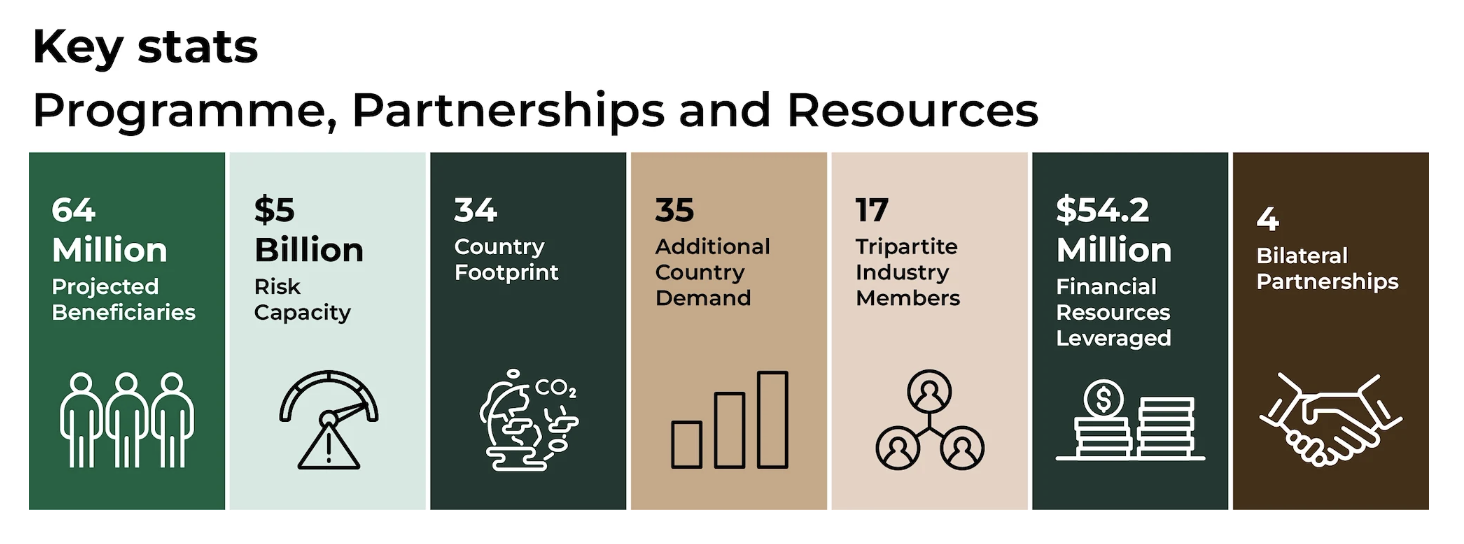

Since its official launch in 2021, UNDP’s Insurance and Risk Finance Facility (IRFF) has grown significantly by adding new countries to its portfolio, diversifying its programming, expanding its implementation and policy support in-country, and enhancing its external engagement.

Now working in 34 countries, the IRFF is fast becoming what it was designed to be: a one-stop shop for insurance and risk financing solutions, for families, communities, businesses, and countries in an increasingly risky world. Across agriculture, public assets, health, infrastructure, public financial management and more, the IRFF is working with government to create the right conditions for long-term financial risk management and developing solutions for financial resilience in partnership with the insurance industry.

Partnerships have always been central to the IRFF’s work. UNDP’s largest programme of work in insurance and risk finance is a partnership with the Insurance Development Forum and 17 of the world’s largest insurance companies, financed by the German government. The partnership, known as the Tripartite Agreement, is active in 22 countries and supported by up to $5 billion in risk capacity from industry. A new programme with the Bill and Melinda Gates Foundation, focused on building the financial resilience of smallholder farmers to climate risks, relies on strong partnerships - starting with farmers, through to insurers and regulators, and up to the value chain actors that depend on the farmers’ products for their business operations.

And alongside these large-scale initiatives, UNDP has bilateral partnerships with key members of the insurance industry to bring their expertise directly to countries and communities. Together with Milliman, a leading actuarial services provider, the IRFF is supporting insurance market development in all of its programme countries. This year, the IRFF launched with two Insurance Innovation Challenge Funds (IICF) with partners– Generali and the International Cooperative and Mutual Insurance Federation (ICMIF) - and will launch another IICF for its programme countries later this year - supporting the development of innovative insurance solutions with at least fifty national insurers in 25 countries.

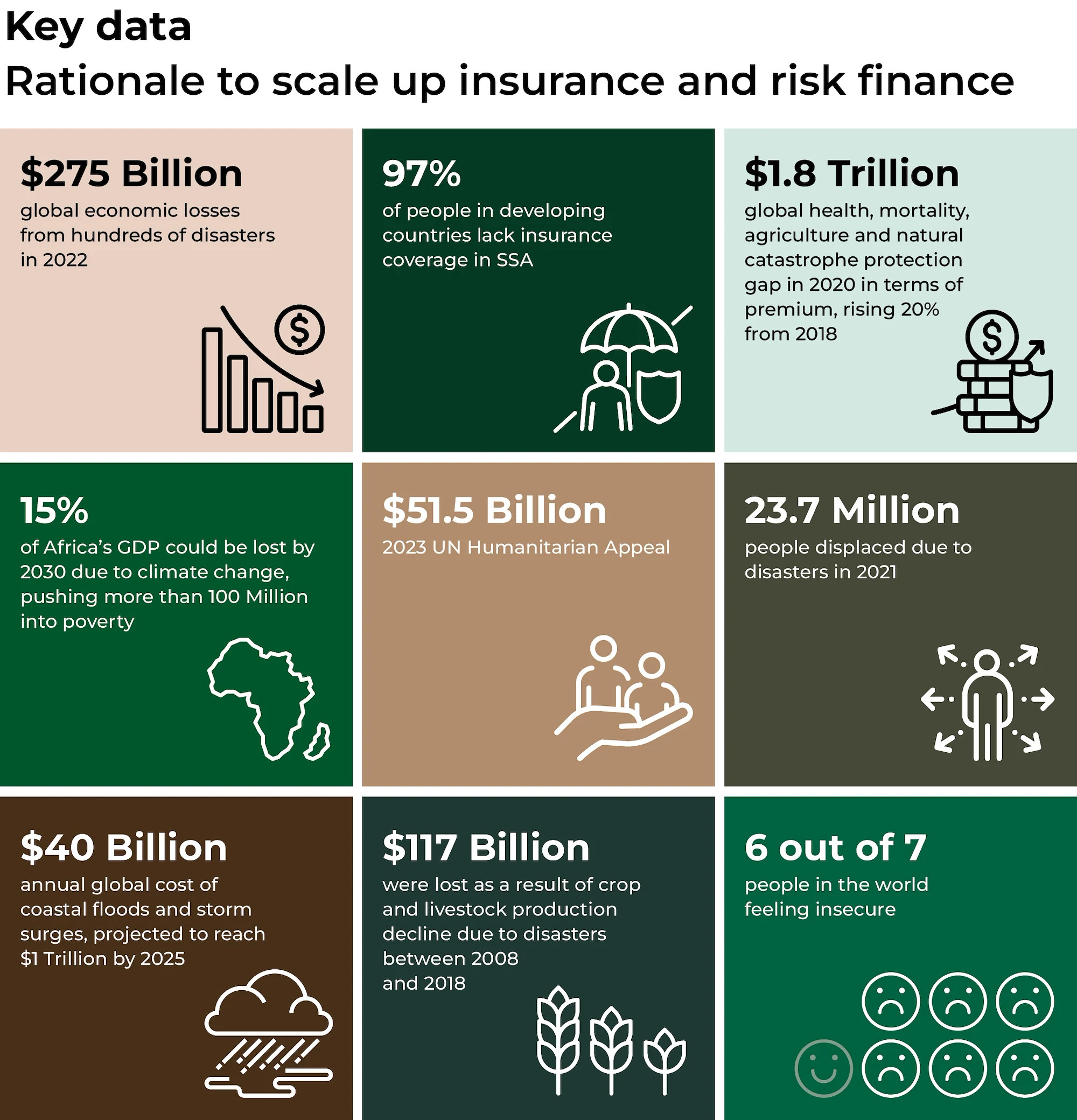

For the first time in the 32 years since UNDP has been measuring development progress, development has declined due to the impacts of the pandemic, climate change, socioeconomic instability, and conflict - all of which have compounded to push more people into poverty and erode decades of hard won development progress.

The gap between what is insured and not insured in developing countries is as much as 90% and beyond. At the same time, the UN humanitarian appeal for 2023 topped US$50 billion for the first time, more than ten times what it was ten years before. It is starkly evident that not only does the burden of financial risk fall heavily on the shoulders of the developed nations and their communities, but international response to date has been largely dominated by reaction, not prevention, and not financial resilience.

However, the 2022 Human Development Report also highlighted how insurance, in addition to investment and innovation, can help countries and communities to navigate increasing uncertainty and manage the panoply of risks they face.

UNDP'S INSURANCE AND RISK FINANCE FACILITY IS NOW WORKING IN 34 COUNTRIES STRETCHED ACROSS FIVE REGIONS TO SUPPORT COUNTRIES BUILD FINANCIAL RESILIENCE

AS THE WORK DEVELOPS AT THE COUNTRY LEVEL, THERE ARE STRONG EXAMPLES OF HOW INSURANCE CAN SUPPORT LONG-TERM AND SUSTAINABLE DEVELOPMENT BY PROTECTING GAINS AND ANTICIPATING INCREASING RISKS AND DAMAGE

WALK THE INSURANCE TALK

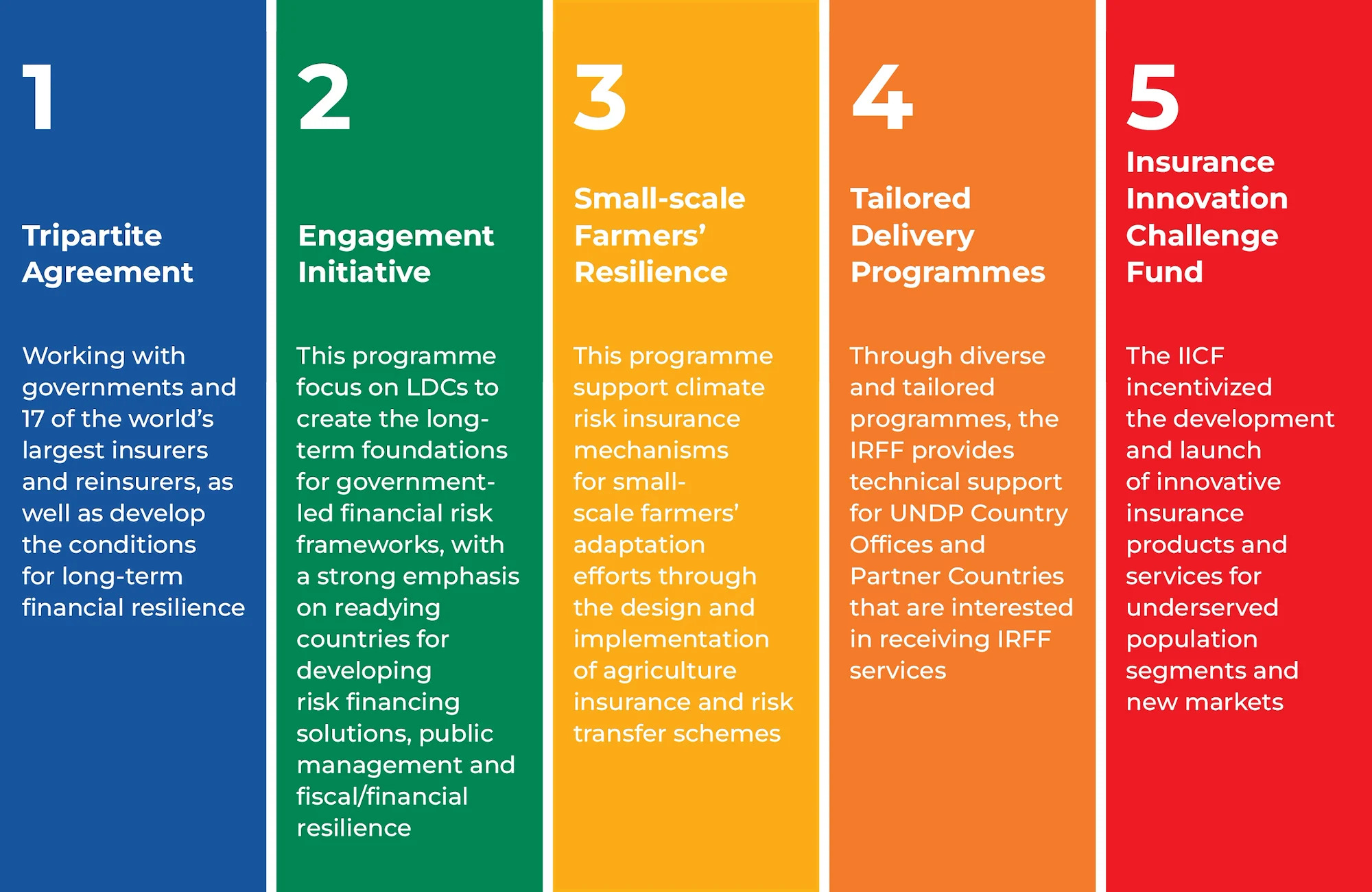

UNDP’s insurance and risk finance work covers everything from sovereign risk financing and insurance market development to public financial management and gender equality. Through its programmes, the IRFF’s work touches upon almost all of the SDGs and almost all aspects of life and living.

From stable middle-income countries to fragile states, the IRFF puts risk transfer at the heart of development in all of its programme countries. Through five key initiatives, the IRFF continues to expand its programming to deliver insurance and risk finance solutions to more people, communities, businesses, and countries.

In the country examples below you can see some examples of how the IRFF is building the capacity of ministries of finance, supporting insurance market development, developing complex risk finance solutions in partnership with industry, and much more.

Sign up to UNDP IRFF's newsletter to keep up to date with countries' progress.

MEXICO: AGRICULTURE INSURANCE FOR SMALLHOLDER FARMERS

TRIPARTITE AGREEMENT COUNTRY

Mexico has seen a drastic increase in the frequency and severity of disasters in recent years with a strong impact on the country’s economy, especially in the agriculture sector. Over the last two decades, more than 80 percent of total economic losses from weather-related disasters affected the sector, with 87 percent of maize farmers in Southern Mexico reporting negative effects due to climate change and weather events. Smallholder farmers, who often cultivate non-irrigated lands, are the most vulnerable to crop losses caused by floods and droughts.

In collaboration with the Secretariat of Treasury and Public Credit and Secretariat of Agriculture and Rural Development in 2022, Mexico's Tripartite project has successfully developed and piloted a sovereign parametric insurance solution that covers over 10,000 smallholder farmers against floods and droughts. The coverage was triggered twice during the pilot test, and over 1,400 producers received a direct payment to make their livelihoods and communities more resilient against climate change.

The positive results of the pilot test were submitted to the Secretariat of Treasury and Public Credit, who will in turn seek Federal resources for premium payments to continue with the extension of the project in 2024 through the Federal Budget. In addition to playing a coordination, project management and convening role, the IRFF works closely with the Government of Mexico to make risk management and transfer central to the way in which the country tackles both climate change and development.

The IRFF’s wider work in Mexico also includes an example of the commitment to make gender and women's empowerment central to all of its programming, with dedicated activities on gender-focused financial literacy and policy development training for government agencies, leading to the creation of a more equitable financial risk management and insurance market environment.

PAKISTAN: BUILDING LONG-TERM FINANCIAL RESILIENCE AFTER THE 2022 FLOODS

TRIPARTITE AGREEMENT COUNTRY & GLOBAL SHIELD CONVENING

Pakistan is one of the countries most vulnerable to climate change, especially flooding due to deforestation and glacial melt. This was underscored in the 2022 floods, which caused over $30 billion in economic losses and affected 33 million people, with a significant portion of the Indus Valley submerged in floodwaters. And this just after a similar level of flooding, in 2010.

Financial resilience is very low across the country. Public assets are not uniformly covered by insurance and Pakistan's insurance penetration stands at a mere 0.9% (non-life at 0.29%) of Gross Domestic Product which means, the weight of financial risk sits heavily on the shoulders of every Pakistani family, business and institution. And more than that, reconstruction and recovery, if it is to be done, has to be from ‘new’ money, a significant challenge to a country like Pakistan that has a constrained fiscal space.

UNDP’s support to Pakistan in the insurance and risk financing space is considerable and covers many areas, and much of it responds directly to the country’s Resilient Recovery, Rehabilitation, and Reconstruction Framework (4RF). The 4RF emphasizes the need to not only rebuild, but to also enhance the nation's resilience, with a focus on insurance and risk financing as two of the strategic priorities. As a Tripartite country, UNDP is working to construct a significant risk financing solution with its partners in industry, while also investing in insurance market development across a set of critical sectors. A major conference later this year, looking to look again at putting risk transfer at the heart of Pakistan’s development, is part of this work. In addition, UNDP has been asked by the Pakistani government to support Pakistan’s engagement with the Global Shield Against Climate Risks, a V20 and G7 initiative to support Climate and Disaster Risk Finance and Insurance solutions, by helping to convene and coordinate efforts to bring additional much-needed risk transfer financing to the country.

TANZANIA: BUILDING THE FINANCIAL RISK MANAGEMENT OF TANZANIA’S AGRICULTURAL SECTOR

TRIPARTITE AGREEMENT COUNTRY & SMALL-SCALE FARMERS' RESILIENCE COUNTRY

Tanzania is prone to risks from extreme weather events such as increased seasonal variation in rainfall and temperature, and frequent and prolonged droughts and floods. It is estimated an annual average economic loss of $140 million due to drought-related yield losses of the main crops (including banana, potato, etc.) under current climate conditions. UNDP’s insurance and risk financing work in Tanzania comes through the Tripartite Agreement, and the Small-scale Farmers’ Resilience programme, funded by the Bill and Melinda Gates Foundation. The Tripartite project focuses on risk finance solutions and long-term transformation of insurance markets while the Small-scale Farmers’ Resilience project work focuses primarily on building the financial resilience of small-holder farmers to climate risks. Long-term financial resilience of the agricultural sector is a critical theme throughout both programmes. Much of this work has been guided through the diagnostic report on Tanzania’s insurance and risk financing landscape, which has helped direct UNDP and its partners to start developing long-term sovereign financial solutions alongside the development of the agricultural market in key commodities.

And alongside these large-scale initiatives, UNDP has bilateral partnerships with key members of the insurance industry to bring their expertise directly to countries and communities. Together with Milliman, a leading actuarial services provider, the IRFF is supporting insurance market development in all of its programme countries. This year, the IRFF launched with two Insurance Innovation Challenge Funds (IICF) with partners– Generali and the International Cooperative and Mutual Insurance Federation (ICMIF) - and will launch another IICF for its programme countries later this year - supporting the development of innovative insurance solutions with at least fifty national insurers in 25 countries.

Tanzania also benefits from several additional areas of technical assistance work delivered by UNDP and its partners. Its key ministry and agency colleagues have taken part in a detailed Training on Climate and Disaster Risk Financing (CDRF) as well as an International Certification in Inclusive Insurance to support the transformation of the insurance landscape in Tanzania. Tanzania is also part of UNDP-Milliman Global Actuarial Initiative (GAIN) assessment which highlighted key limitations in Tanzania, such as a shortage of qualified actuaries, which has led to dependence on other countries for actuarial support. Given these challenges, UNDP is scaling efforts to build local actuarial capacity in partnership with government and insurance entities, through comprehensive five-year strategy featuring an Actuarial Professional Course and a mentorship program, which provides training to students to strengthen Tanzania's actuarial expertise. Learn more about Tanzania's insurance and risk finance landscape in the diagnostic here.

Government officials, private sector and other stakeholders taking part on the International Certification in Inclusive Insurance to support countries in transforming the insurance landscape in Tanzania.

TRIPARTITE AGREEMENT COUNTRY

Like many countries in Africa, Ghana is highly vulnerable to hazards and shocks driven largely by climate change. Flooding is one of the most damaging of Ghana’s hazards and, over the last 50 years, the country has seen more than 30 major floods, 17 of which directly impacted the country’s capital, Accra. Ghana’s population (31 million in 2020) meanwhile is expected to double in the next 30 years, and much of that is likely to occur in urban areas of contribute to the rapid urbanization the country is already facing. Many urban citizens of Accra and other cities are relatively poor and vulnerable, suffering disproportionately from both high exposure to flooding and weak financial resilience - 70% of Ghanaians have no access to insurance and 42% of the population has no access to financial services.

In collaboration with the Ministry of Finance and the National Disaster Management Organisation (NADMO), the Tripartite project in Ghana focuses on building the financial resilience of low-income communities in the Greater Accra Region and enabling them to re-establish their economic activities after a severe flood through a parametric insurance product, while enhancing the response capacity of NADMO. The solution is expected to benefit an estimated 5.67 million individuals in the region and make a long-term impact on the financial resilience of urban Ghanaians, and is being considered for expansion to other coastal cities.

In addition to playing a coordination, project management and stakeholder convening role, the IRFF continues to work on the long-term financial risk management structure of the country including the development of a contingency plan for disaster risk finance which was adopted by the government.

The IRFF is also collaborating with the Ghana Insurance College (GIC) to roll out a certified Inclusive Insurance Training Programme and with the National Insurance Commission for the creation of an inclusive insurance regulatory roadmap. Ghana has also benefited from the GAIN partnership with Milliman to enhance actuarial skills and data analysis capacities and improve local risk modeling. All of the IRFF’s work in Ghana is guided by the insights gained through its diagnostic process, which summarizes the country’s insurance and risk finance landscape.

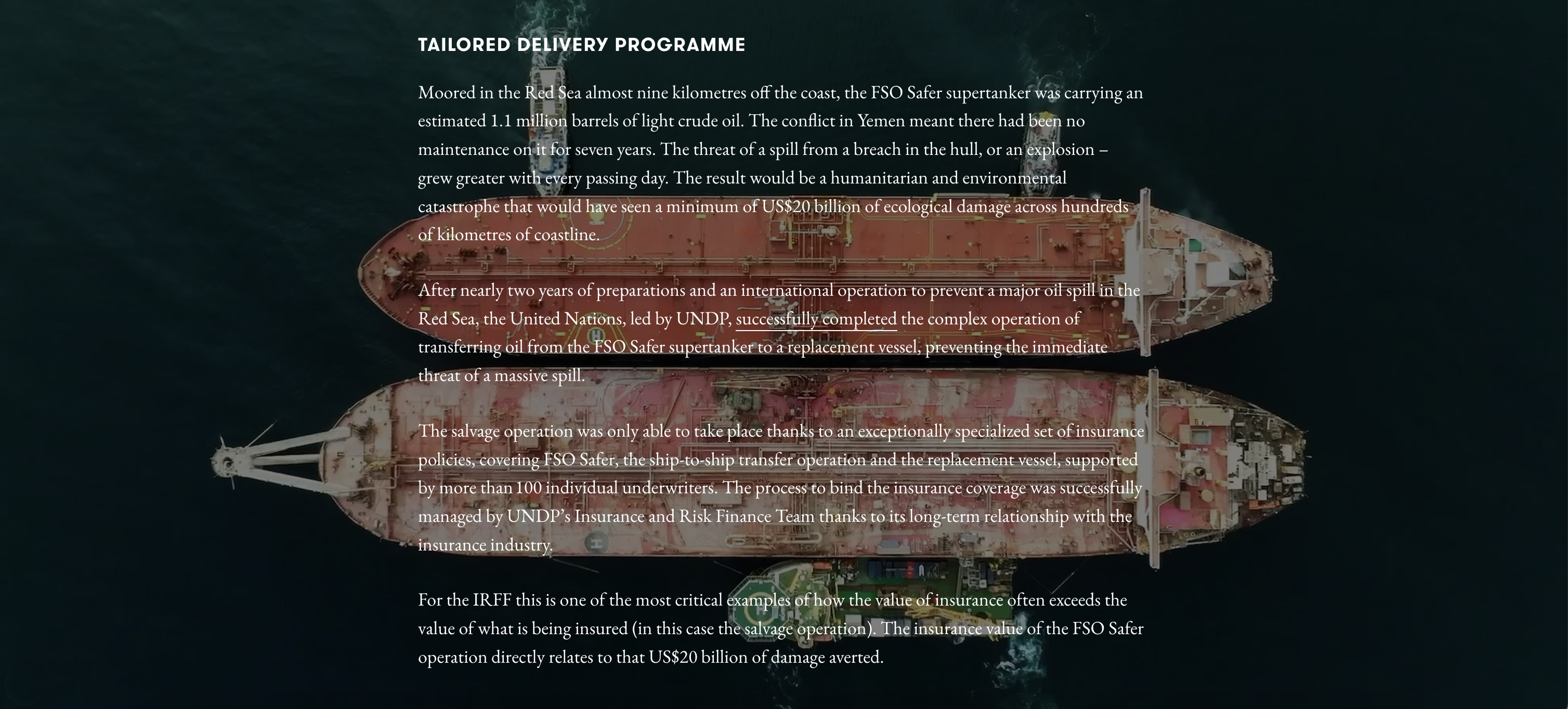

Click the photo to view the whole story of the FSO safer salvage: insurance as a catalyst to prevent US$20 Billion of damage

BUILDING PARTNERSHIPS TO ACHIEVE FINANCIAL RESILIENCE FOR ALL

The IRFF has nurtured and scaled partnerships to enable the Facility to leverage expertise, resources, and networks to advance its mission of promoting sustainable and inclusive development through insurance and risk finance solutions. Strategic partnerships for strategic goals:

The International Cooperative and Mutual Insurance Federation (ICMIF)

BOOSTING FINANCIAL PROTECTION FOR VULNERABLE POPULATIONS

ICMIF has co-financed an Insurance Innovation Challenge Fund with the IRFF to incentivize mutual and cooperative insurers to develop insurance products for vulnerable and low-income populations. The UNDP-ICMIF Challenge Fund selected four projects in India, Kenya, Sri Lanka, and Malawi to scale existing microinsurance programmes to reach new customers and markets.

MILLIMAN

ENHANCING INSURANCE MARKET DEVELOPMENT

In September 2022, UNDP and Milliman created the Global Actuarial Initiative (GAIN) to help developing countries better understand and manage their climate risks by building actuarial capacity and deepening insurance markets. One year later, this bold and unique initiative is thriving; more than 50 Milliman “ambassadors” have delivered workshops in 10 IRFF programme countries and the remaining countries will participate in the GAIN in 2024.

GENERALI

SUPPORTING SME RESILIENCE

Under this 3-year partnership, Generali and the IRFF are working together to advance SMEs’ (small and medium enterprises) resilience to climate risks. The partnership recently launched an Insurance Innovation Challenge Fund for Malaysia, and will deliver an SME Loss Prevention Framework by the end of 2023 and a report on MSME Resilience in ASEAN, with a specific focus on Thailand and Malaysia, in Q1 2024.

THE FUTURE: PROTECTING A WORLD OF RISING RISKS

Despite the rising frequency, severity and complexity of crises, the financial resilience of millions of communities worldwide remains staggeringly low. Only three of every 100 people in sub-Saharan African have insurance of any kind. The protection gap (the gap between insured and uninsured losses) in developing countries remains well over 90% in many developing countries.

The financial risk of crisis sits of the shoulders of almost every person in developing countries. And yet the volume of development resources going into financial risk management, whether through public financial management, sovereign and sub-sovereign risk finance solutions, or insurance market development, remains very low. The vast majority of crisis financing still occurs after crisis, if it happens at all.

THE DEMAND FOR FINANCIAL RESILIENCE SERVICES IS RAPIDLY INCREASING

In just the last year, UNDP's Insurance and Risk Finance Facility received requests from 35 countries beyond its existing resources, asking for a range of support across insurance, risk financing and risk transfer. The expanding volume of these requests underlines not only the general need for more resources for insurance and risk financing but also a recognition of how UNDP itself can and should expand its work in this space, bringing in more expertise, building more partnerships, and increasingly helping more countries put risk transfer at the heart of development.

Some of the trends of the year ahead:

New Initiatives Developed and Delivered

A new set of initiatives and work are already planned for delivery in 2024, including the launch of the global Challenge Fund and the IRFF training platform for countries and insurance practitioners in developing countries. There will be a strong focus on the integration of insurance and risk financing into development, with work on the interplay of risk transfer with Nationally determined contributions (NDCs), National Adaptation Plans (NAPs), Public Financial Management initiatives and Integrated National Financing Frameworks.

Partnerships Enhanced and Scaled

UNDP will continue to develop and implement its existing partnerships, including the 17 industry partners of the Tripartite Agreement and the bilateral partnerships with ICMIF, Generali, and Milliman - making good on its commitment to be a foundation for increased technical and financial resources for at-risk countries. Several new partnerships will also be launched in 2024 – watch this space!

Global Ecosystem for Insurance and Risk Financing Expands

It is highly likely that 2024 will see further investment in the global ecosystem for risk transfer, especially as attention shifts to the creation of a Loss and Damage fund ready for COP28. UNDP, through its work within the UN System, Global Shield Against Climate Risk, Insurance Development Forum, and more, will continue to play its role in putting insurance and risk financing at the heart of development and working with government and partners to build the financial resilience of communities and countries across the world.

The IRFF Continues to Grow

To meet the growing demand both within existing countries of operation and beyond to new countries, the IRFF's ambition is to grow operational work to 50 countries by 2025. This expansion will be both geographic and programmatic, with new areas of added that have been in development, such as dedicated work for fragile and conflict-affected states.

ALL THESE DEVELOPMENTS ALIGN WITH THE IRFF'S COMMITMENT TO PROACTIVELY ADDRESS RISKS AND BUILD FINANCIAL RESILIENCE IN AN INCREASINGLY UNCERTAIN WORLD.

Get in touch with us at irff@undp.org.

"ICMIF is excited about this new joint endeavor with UNDP to support the world’s poorest communities and build resilience in the face of climate, health and other shocks."

— Rob Wesseling, President and CEO, Co-operators (Canada) and Chair , ICMIF Foundation

“Working jointly with UNDP, Milliman will contribute to the growth of actuarial expertise and help countries and the insurance industry to better manage the increasing risks faced by people and enterprises in developing countries.”

— - Ken Mungan, Chairman , Board of Milliman

“This innovative partnership with UNDP is seeing Generali utilise its expertise from across the world, and locally in Asia, to help boost an insurance culture which will be essential for the region’s future success.”

— Jaime Anchústegui Melgarejo, CEO, International of Generali